Best Payment Gateway Solutions for Europe & Middle East High-Risk Businesses in 2025

22 November 2025

Most forex brokers, gaming platforms, CBD merchants, and adult entertainment sites across Europe and the Middle East face constant rejections from standard processors. Traditional providers either decline these businesses outright or impose restrictive terms - excessive rolling reserves, punishing chargeback fees, monthly volume caps - that make sustainable growth nearly impossible.

Finding a partner who understands both EU regulations like PSD2 and GCC requirements for Saudi Arabia, UAE, Kuwait, and Bahrain is the real challenge. A merchant approved for EUR transactions in Germany might find Saudi customers facing 70% declined payments due to poor Mada network integration or lack of local acquiring relationships.

This guide compares payment gateways delivering high approval rates, strong regional compliance, and local payment method support that transforms abandoned checkouts into completed purchases.

What makes payment processing "high-risk" in these regions?

Traditional banks and processors avoid high-risk businesses due to elevated chargeback rates threatening card network standing, complex regulatory frameworks requiring specialized compliance expertise, and perceived reputational issues. If you operate in forex trading, CBD retail, adult content, gaming, or cryptocurrency, you've experienced this through declined applications or sudden account terminations.

Classification extends beyond industry vertical. Processors evaluate multiple risk factors: average transaction values consistently exceeding $500 trigger additional scrutiny, customer distribution spanning multiple jurisdictions creates compliance complexity, subscription billing models face extra examination due to higher dispute potential, and historical chargeback rates determine eligibility. A gaming platform maintaining excellent 0.8% chargebacks still gets classified high-risk because the gaming vertical industry-wide experiences elevated dispute rates versus traditional e-commerce.

Geography compounds every challenge. EU merchants navigate PSD2's Strong Customer Authentication requirements with varying implementations across member states, upcoming PSD3 regulations, and GDPR data protection mandates. A payment flow working perfectly for German customers might fail for Polish customers due to differences in how local banks interpret authentication requirements.

Gulf Cooperation Council countries enforce different licensing requirements, often requiring local entity establishment with physical presence before granting processing permissions. A gaming platform approved in Malta might get rejected for Kuwait processing because the gateway lacks GCC expertise and local banking relationships. Saudi Arabia's SAMA licensing typically involves comprehensive regulatory requirements including local incorporation and detailed compliance documentation.

Operating across both regions simultaneously means managing two distinct regulatory frameworks with conflicting requirements, two completely different acquiring bank relationship sets, and two separate risk approaches, all while maintaining consistent customer experiences and reasonable costs. Most traditional processors won't invest the resources required to support this complexity, making specialized high-risk providers essential for merchants serious about serving these markets.

Why does regulatory expertise matter when choosing a gateway?

Payment regulations evolved dramatically across these regions, and the pace continues accelerating. Understanding what's coming in the next 12-24 months matters as much as current compliance, because reactive implementation creates business disruption that proactive preparation avoids.

PSD3, expected late 2025 or early 2026, will introduce stricter authentication beyond PSD2's Strong Customer Authentication mandates. The framework expands open banking access rules, creates new fraud liability standards shifting more responsibility to payment providers, and introduces enhanced consumer protection mechanisms. Gateways lacking proper technical infrastructure will struggle when enforcement begins, potentially forcing merchants to migrate providers mid-stream.

The EU's AML6 directive expands criminal liability to 22 predicate offense categories including cybercrime and environmental crime. Money laundering conviction criteria now extend beyond traditional financial crimes. Payment providers must maintain enhanced due diligence on beneficial owners, implement stricter transaction monitoring for high-risk jurisdictions, and report suspicious activities aggressively. For high-risk merchants, your provider's compliance infrastructure quality directly impacts your ability to maintain stable processing relationships.

In the Gulf, Saudi Arabia's SAMA introduced comprehensive payment services provider regulations requiring new licensing, local entity establishment with physical offices, and detailed compliance documentation many international processors couldn't meet. The UAE's Central Bank implemented similar requirements while introducing real-time payment systems processors must integrate with. Kuwait's Central Bank tightened KYC requirements in 2023, while Bahrain's CBB introduced fintech sandbox frameworks affecting provider operations.

The right provider employs dedicated compliance professionals monitoring regulatory developments, participating in industry working groups, and implementing system changes proactively months before enforcement deadlines. They communicate coming changes to merchants well in advance with clear implementation guidance.

Consider PSD2 Strong Customer Authentication in September 2019 (extended through 2021 for many markets). Providers without proper 3D Secure 2.0 implementation saw authorization rates plummet 15-30% overnight as transactions failed authentication. Sophisticated providers who had implemented 3DS2 months earlier, tested with issuing banks, and provided merchant implementation guides experienced minimal disruption and gained market share as competitors struggled.

What features separate specialists from standard processors?

Advanced fraud screening uses machine learning analyzing device fingerprinting, IP geolocation, velocity patterns, and behavioral signals. Adaptive models learn from transaction patterns and adjust thresholds automatically. Sophistication shows false decline rates below 5% with fraud catch rates above 95% - versus 10-15% false declines with 80-85% detection for basic systems.

Chargeback mitigation automates evidence gathering (transaction records, communications, delivery confirmations) then generates response documents within card network deadlines. Early warning systems (Verifi, Ethoca) provide 24-72 hours to issue refunds before disputes become chargebacks. Intercepting 50 disputes monthly could mean maintaining 0.9% ratios versus hitting 1.2% (triggering reviews). Professional representment wins 30-40% of disputes.

Smart transaction routing distributes transactions across acquirers based on real-time approval rates and costs. A merchant processing €2 million monthly at 85% approval loses €300,000 monthly. Intelligent routing across three acquirers increases rates to 91-93%, reducing losses to €140,000-180,000 - a €120,000-160,000 monthly improvement.

Multi-currency settlement eliminates foreign exchange exposure eroding margins 2-4% per transaction. Hold EUR from European transactions, USD from American customers, GBP from UK markets. For merchants processing €5 million monthly across seven currencies, proper management saves €80,000-120,000 annually.

API-first integration with SDKs, webhooks, and detailed error handling makes implementation straightforward. Pre-built plugins for Shopify, WooCommerce, Magento handle 80% of use cases while REST APIs accommodate custom implementations.

Which gateways actually approve EU and GCC high-risk merchants?

| Provider | Approval Rate | EU Coverage | GCC Coverage | Key Industries |

|---|---|---|---|---|

| MoneyEU | 98% | Full EU + UK | UAE, KSA, Bahrain, Kuwait | Gaming, Forex, CBD, Adult, Crypto |

| PaymentCloud | ~98% | Limited | Limited | CBD, Nutraceuticals, Travel |

| Payadmit | High | Full EU | UAE focus | Gaming, Forex, E-commerce |

| NomuPay | High | Moderate | Strong GCC | Trading, Financial Services |

| Ikajo | Moderate | Full EU | Limited | Forex, Binary Options, Gaming |

| Paykings | Moderate | Limited | Moderate | High-Risk E-commerce |

| PayOp | Moderate | Full EU | UAE | Emerging Markets, Crypto |

MoneyEU: The unified orchestration leader

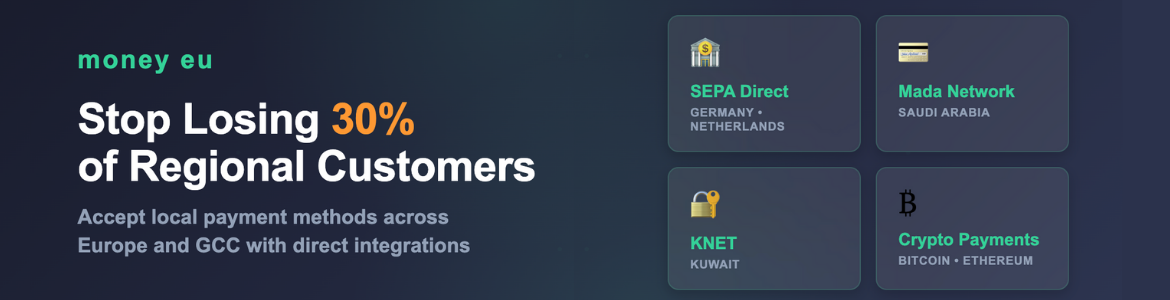

MoneyEU operates as a comprehensive payment orchestration platform serving 1,000+ merchants across four continents with an industry-leading 98% merchant approval rate. The platform supports every payment method high-risk merchants need - all major card networks, ACH and eCheck, cryptocurrency (Bitcoin, Ethereum, USDT, 15+ tokens), international bank transfers via SEPA and SWIFT, and regional alternatives spanning EU and GCC markets - through a single unified API.

Intelligent routing delivers measurable improvements. MoneyEU maintains relationships with multiple acquiring banks, automatically distributing transactions based on real-time approval rates, costs, and geographic optimization. Merchants typically see 4-9% approval improvements within the first month. For a gaming operator processing €800,000 monthly, a 6% improvement translates to €48,000 additional monthly revenue (€576,000 annually).

Direct regional integrations eliminate complexity. MoneyEU maintains direct integrations with local payment networks rather than third-party partnerships. For EU: native SEPA Direct Debit, direct Sofort/Giropay connections, iDEAL integration. For GCC: direct Mada certification in Saudi Arabia, KNET for Kuwait, BenefitPay for Bahrain, SADAD for Saudi recurring payments. Direct architecture reduces payment-related support tickets 40-60%.

High-risk vertical expertise. Underwriting teams bring dedicated expertise in gaming platforms, forex trading, CBD products, adult entertainment, cryptocurrency exchanges, nutraceuticals, travel booking, and subscription SaaS. Underwriters understand gaming economics (€200 average transactions normal), forex 24/7 processing needs, CBD's banking stigma despite legal operation. Account managers provide proactive chargeback reduction strategies and regulatory change alerts.

Comprehensive compliance. PCI DSS Level 1 certification, EMVCo 3-D Secure certification for PSD2/PSD3 compliance, and proper licensing in Saudi Arabia, UAE, Kuwait, and Bahrain including local entity establishment where required.

24/7 dedicated account management. Assigned specialists understand your business model and processing history. Account managers proactively notify about trending issues and make real-time decisions about reserves or volume increases.

Transparent pricing and next-day funding. Clear costs without hidden fees. Next-day funding for strong-history merchants with rolling reserves reviewed every 90 days for reduction. Most merchants start with 5-10% reserves but MoneyEU actively reduces or eliminates reserves for strong metrics.

PaymentCloud: North American focus

PaymentCloud delivers ~98% approval rates with strength in CBD, nutraceuticals, and travel. However, US-based acquiring relationships limit effectiveness for EU and GCC merchants, who may face higher cross-border fees and longer settlement cycles.

Payadmit: European strength, narrow GCC

Payadmit provides solid European coverage with gaming and forex experience. GCC access focuses primarily on the UAE with limited Saudi Arabia, Kuwait, and Bahrain integration.

NomuPay: GCC specialist, moderate EU

NomuPay brings strong Gulf expertise in trading and financial services. European coverage relies on partner networks rather than direct acquiring, introducing complexity for EU transactions.

Ikajo: European alternatives with partner GCC

Ikajo specializes in alternative payment methods with comprehensive European coverage and flexible risk appetite. GCC coverage operates through partners, introducing integration complexity versus MoneyEU's direct integrations.

Paykings: Basic processing, geographic limitations

Paykings accepts various high-risk merchants with straightforward approvals. Limited regional expertise in both EU and GCC makes them better suited for North American-focused merchants.

PayOp: Payment diversity, mixed reliability

PayOp offers 500+ payment methods with emerging markets and cryptocurrency strength. EU coverage is comprehensive, GCC focuses on the UAE. User reviews indicate mixed platform reliability compared to specialized providers.

Ready to discuss payment solutions? Contact MoneyEU at marketing@moneyeu.com.

How do regional payment methods boost conversion?

Supporting regional preferences increases conversion 15-30% by reducing friction and building trust.

SEPA transfers remain preferred in Germany, Netherlands, Austria. Standard SEPA settles in 1-2 days with fees under 0.5% versus 2-3.5% for cards. Instant SEPA settles within 10 seconds. Benefits: lower costs (critical when card fees run 3.5-4.5% for high-risk), virtually zero chargeback risk, simplified reconciliation. SEPA Direct Debit achieves 90%+ recurring billing success versus 15-20% card decline rates.

Sofort and Giropay dominate German-speaking markets with instant confirmation and 8-15% higher conversion than cards. Processing fees of 0.9-1.4% versus 3.5-4.5% high-risk card rates create substantial savings.

Mada and SADAD are essential for Saudi Arabia. Mada processes the vast majority of Kingdom transactions with superior approval rates versus international cards. SADAD handles recurring payments for significant portions of Saudi customers preferring bank debits.

KNET and BenefitPay dominate Kuwait and Bahrain as national networks. KNET delivers substantially higher approval rates versus international cards. Both reduce per-transaction fees 30-50% while improving approvals significantly.

Apple Pay and Google Pay improve mobile conversion 20-40% through tokenized security and biometric authentication. Tokenization improves issuing bank approvals 5-8%. Critical for GCC markets where smartphone penetration exceeds 95%.

Cryptocurrency (Bitcoin, Ethereum, USDT) provides instant settlement, global reach, and reduced chargeback risk. MoneyEU handles all compliance - AML monitoring, tax reporting, wallet screening.

Why MoneyEU delivers the best cross-regional solution

High-risk merchants operating across Europe and the Middle East need specialized expertise and infrastructure. MoneyEU's unified platform delivers the approval rates, compliance support, and regional payment method coverage ambitious businesses require.

The 98% merchant approval rate reflects deep banking relationships and risk management expertise built for challenging verticals. MoneyEU routes transactions intelligently, supports localized methods from SEPA to Mada, and provides 24/7 dedicated account management.

Contact the team at marketing@moneyeu.com for a tailored assessment.

Frequently asked questions

What fees should I expect from a high-risk gateway in Europe?

High-risk gateways charge higher fees due to increased risk exposure. Expect setup fees ($0-$500, often waived), monthly account fees ($50-$200 depending on volume), and per-transaction costs (2.5-5% plus $0.25-$0.50). Some implement rolling reserves (5-10% of monthly volume held for 180 days) and chargeback fees ($15-$25 per dispute). MoneyEU offers competitive pricing with comprehensive regional coverage and direct payment method integrations without hidden junk fees.

Can I reduce rolling reserves over time?

Most processors review reserves based on processing history and chargeback ratios. Merchants typically see reductions after 6-12 months of stable processing and low dispute rates (below 0.75%). MoneyEU conducts reviews every 90 days rather than annually, helping strong performers reduce reserves from 10% down to 5% or eliminate them entirely.

How do I prevent sudden account termination?

Maintain open communication about business changes, monitor chargeback ratios closely, and confirm strict compliance with regulations. Choose processors like MoneyEU with clear violation policies and dedicated account managers. Keep offerings transparent and document all transactions thoroughly with delivery confirmations and IP verification. MoneyEU's team works proactively to address issues before escalation.

What's the difference between payment gateway and merchant account?

A merchant account is a bank account that temporarily holds transaction funds. A payment gateway is the technology that transmits transaction data between your website, the customer's bank, and your merchant account. High-risk merchants need both - a willing bank and secure technology. MoneyEU provides integrated solutions handling both through a single partnership.

How long does high-risk merchant account approval take?

Standard processors may take weeks. Specialized providers like MoneyEU typically complete approval within 3-7 business days for straightforward applications. More complicated scenarios might require 10-14 days. Timeline depends on documentation speed: business registration, processing statements, business plan, ownership structure, and compliance documentation. MoneyEU's dedicated underwriting expedites approvals without compromising due diligence.

Which industries face the most payment processing challenges?

Gaming platforms, forex trading, CBD businesses, adult entertainment, cryptocurrency exchanges, nutraceuticals, travel/ticketing, and subscription services all face elevated scrutiny. MoneyEU specializes in exactly these verticals with proven track records of maintaining stable processing relationships across both EU and GCC regulatory environments.

About the Author

Pranav Khanna is a payment processing specialist with over 8 years of experience helping high-risk businesses secure merchant accounts and optimize payment infrastructure. He has worked with hundreds of merchants across gaming, CBD, forex, and e-commerce industries. Connect with him on LinkedIn for insights on payment processing trends.