Hybrid Payment Solutions 2025: Traditional Card + Crypto Multi-Method Processing

5 November 2025

Customers abandon checkout when their preferred payment method isn't available. Whether it's a declined card, high cross-border fees, or regional restrictions, businesses lose sales every day by offering only one payment option. Hybrid payment solutions combine traditional card processing with cryptocurrency acceptance through a single platform, letting you capture more transactions while cutting costs and settlement delays.

This guide covers how hybrid systems work, compliance requirements spanning PCI DSS and crypto regulations, cost comparisons between payment methods, and what to look for when choosing a gateway that supports high-risk and international businesses.

What Are Hybrid Payment Solutions and Why Do They Matter?

Hybrid payment solutions let you accept both traditional cards (Visa, Mastercard, Amex) and cryptocurrency (Bitcoin, Ethereum, stablecoins like USDT and USDC) through one platform. Instead of juggling separate processors for cards and crypto, you integrate once and give customers the choice at checkout.

For businesses serving international customers or operating in high-risk industries, this dual-rail approach solves critical pain points around approval rates, fees, and settlement speed.

How Do Hybrid Payments Increase Global Approval Rates?

If a card declines because of issuer rules or geographic blocks, the customer can retry immediately with crypto. Cards and crypto follow different approval logic: card networks check credit limits and fraud signals, while crypto transactions only need wallet balances and network confirmation.

For high-risk merchants in gaming, CBD, nutraceuticals, and forex trading, offering both payment methods captures sales you'd otherwise lose to false declines. Card approval rates often drop below 70% with mainstream processors in these industries.

Can Hybrid Processing Lower Cross-Border Fees?

International card payments stack up fees fast. Cross-border processing fees from networks like Mastercard range from 0.6% to 1%, while Visa charges 1% to 1.4% of the transaction amount. When combined with interchange fees, foreign transaction charges, and correspondent banking costs, total international card fees often hit 3–5% or more.

Crypto payments settle directly on blockchain networks without middleman banks, cutting costs to gas fees and exchange spreads. Average Bitcoin transaction fees in 2025 dropped to $1.74, while Ethereum's average gas fees fell to $0.38 thanks to Layer 2 adoption. For businesses processing $100,000 monthly in international transactions, the difference between 4% card fees and 1.5% crypto fees equals $2,500 in monthly savings.

What About Settlement Speed?

Card payments follow the T+2 cycle, and international transactions can stretch to 5–7 days. Crypto transactions confirm within minutes to hours depending on the blockchain. Many gateways convert crypto to fiat instantly at checkout, so you get funds in hours instead of days.

How Hybrid Payment Processing Works

Dynamic Payment Routing

Smart routing picks the best payment method in real time based on customer preference, transaction size, location, and success history. If the gateway spots a high chance of card decline, it can prompt the customer to try crypto instead, maximizing approvals while keeping costs down.

Security Across Both Methods

Card payments use tokenization, replacing sensitive card data with secure tokens, to reduce your PCI DSS compliance burden. Crypto payments generate unique wallet addresses for each transaction, routing funds without exposing private keys. Both methods converge in one security setup where the gateway handles sensitive data and you only see transaction IDs.

Real-Time Conversion

Hybrid gateways offer instant conversion at checkout: a customer pays in Bitcoin, and you receive EUR or USD within seconds. The gateway locks the exchange rate at authorization, protecting you from crypto price swings. Some merchants hold a portion of crypto receipts for treasury diversification. Modern platforms support split settlement (70% fiat, 30% stablecoin).

What Compliance Requirements Apply?

PCI DSS and Card Network Rules

Card compliance stays the same in hybrid systems: maintain PCI DSS certification appropriate to your volume and integration method. PCI DSS compliance levels are based on annual transaction volume, with Level 1 merchants (over 6 million transactions) requiring annual audits by Qualified Security Assessors. The gateway typically handles Level 1 PCI compliance, but you still follow secure coding practices.

How Do AML and KYC Requirements Work for Crypto?

Crypto transactions trigger anti-money laundering (AML) and Know Your Customer (KYC) checks depending on your jurisdiction and volume. Most gateways verify business identity at account setup, then monitor transactions for suspicious patterns. The travel rule, requiring customer information for transactions above $1,000 USD, applies when moving crypto between regulated entities.

European Regulations: MiCA

Europe's Markets in Crypto-Assets Regulation (MiCA) sets licensing standards for crypto service providers. MiCA became fully applicable on December 30, 2024, requiring crypto-asset service providers (CASPs) to obtain authorization. If you operate in the EU or serve EU customers, pick gateways registered under MiCA. For forex and investment platforms, MiFID II rules layer on top of payment processing requirements.

Chargeback and Fraud Management

Card chargebacks: Customers can dispute charges for up to 120 days through their issuing bank (with some exceptions). You respond with evidence and pay a chargeback fee ($15–$100) if you lose.

Crypto finality: Blockchain transactions can't be reversed once confirmed. No chargeback mechanism exists, so you bear full fraud risk. This demands stronger upfront checks: email verification, wallet whitelisting, velocity limits.

Fraud scoring: Combined signals from both methods (device fingerprints, IP location, transaction velocity, wallet reputation) feed unified fraud engines that flag risky transactions.

Card vs Crypto: Costs, Speed, and Chargebacks

Card Fee Structure

Card processing breaks into three layers: interchange (1.5–3%), assessment fees (0.1–0.15%), and processor markup (0.3–1% or more). International transactions add foreign exchange spreads and cross-border fees (0.6–1.4%) extra. High-risk merchants face reserve holds (5–10% of monthly volume) and higher markups.

Crypto Costs

Crypto payments incur gas fees. Bitcoin and Ethereum mainnet costs vary, with Bitcoin fees averaging around $3.95 per transaction and Ethereum around $8.50 on mainnet in early 2025. However, Layer 2 solutions handle 63% of Ethereum transactions, with platforms like Arbitrum averaging just $0.03 per transaction. Exchange spread is the buy-sell price difference when converting crypto to fiat, usually 0.5–1.5%. Stablecoins (USDT, USDC) minimize volatility during conversion.

Comparison Table

| Feature | Card Payments | Crypto Payments |

|---|---|---|

| Settlement speed | 2–7 business days | Minutes to hours |

| Typical fees | 2.5–5% (higher for high-risk) | 1–2% (network + conversion) |

| Chargeback risk | Yes (up to 120+ days) | No (irreversible) |

| Geographic reach | Requires local acquiring | Borderless |

| Fraud liability | Shared | Merchant responsibility |

Top Hybrid Payment Gateways for High-Risk Businesses

Money EU: The Complete Solution for High-Risk Merchants

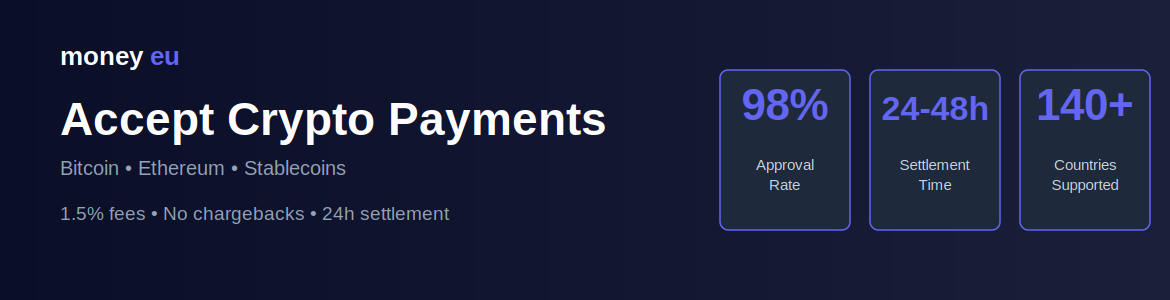

Money EU leads the hybrid payment space for high-risk and hard-to-place businesses. Founded in 2014 and operating across America, Europe, India, and Africa, Money EU serves 1,000+ merchants with a reported 98% approval rate.

Why Money EU stands out:

Comprehensive payment methods: Money EU offers cards (Visa, Mastercard, Amex, JCB), crypto (Bitcoin, Ethereum, USDT, USDC), eChecks, bank transfers (SEPA, SWIFT), digital wallets (Apple Pay, Google Pay, Alipay, WeChat Pay), and alternative payment methods through a single API integration.

High-risk industry expertise: Money EU specializes in forex trading, online gaming, CBD, adult entertainment, nutraceuticals, travel, and other verticals mainstream processors decline. Their underwriting team works with acquiring banks willing to board high-risk businesses.

Multi-currency settlement: Direct settlement in EUR, GBP, USD, CAD, INR, AED, and other regional currencies eliminates double conversion fees. Treasury features let you hold balances in multiple currencies and convert at optimal times.

Fast onboarding: Quick merchant approvals with next-day funding for many transactions improve cash flow. The transparent onboarding process gets you processing within days.

Dedicated compliance support: For businesses operating under MiFID II, MiCA, gambling licenses, or CBD restrictions, Money EU assigns dedicated risk analysts and compliance managers. They help tune fraud rules, respond quickly to issues, and generate audit-ready reports.

Pricing: Competitive rates starting at 1.8% for card transactions and under 1.5% for crypto payments, with no hidden fees. Transparent pricing without excessive markups.

24/7 support: Round-the-clock expert help with a unified dashboard for monitoring all payment methods. Real-time analytics show approval rates, decline reasons, settlement status, and chargeback trends.

Contact: marketing@moneyeu.com for customized pricing and industry-specific solutions.

PaymentCloud: U.S.-Focused Processing

PaymentCloud caters to U.S.-based high-risk merchants with quick approvals. They advertise a 98% approval rate and have a 4.7/5 stars Trustpilot rating.

Strengths: U.S. market expertise, quick setup. Limitations: Primarily card-focused with limited crypto options compared to Money EU. Less competitive for international merchants.

Payadmit: European Solutions

Payadmit offers card processing for European merchants, focusing on iGaming and forex verticals.

Strengths: EU banking relationships. Limitations: Limited geographic reach outside Europe, fewer payment methods than Money EU.

NomuPay: Enterprise-Scale

NomuPay provides payment orchestration for larger enterprises with complex needs.

Strengths: Enterprise infrastructure. Limitations: Higher setup costs, less suitable for small to mid-sized merchants.

Ikajo: Emerging Markets

Ikajo specializes in high-risk card processing with a focus on CIS countries.

Strengths: CIS market coverage. Limitations: Limited crypto capabilities, fewer alternative payment methods.

Paykings: U.S. High-Risk Specialist

Paykings offers merchant accounts for high-risk U.S. businesses focusing on CBD and subscriptions.

Strengths: Fast U.S. approvals. Limitations: Primarily U.S.-focused, limited international capabilities.

PayOp: Multi-Method Platform

PayOp integrates 500+ payment options across Europe.

Strengths: Wide variety of methods. Limitations: Mixed reviews (3.7/5 Trustpilot), less specialized high-risk expertise.

Gateway Comparison

| Provider | Approval Rate | Crypto Support | Multi-Currency | Support | Starting Rates |

|---|---|---|---|---|---|

| Money EU | 98% | Full (BTC, ETH, stablecoins) | EUR, GBP, USD, CAD, INR, AED+ | 24/7 | 1.8% / <1.5% crypto |

| PaymentCloud | 98% | Limited | USD primary | Yes | 2.5%+ |

| Payadmit | ~85% | Basic | EUR, USD | Standard | 2.2%+ |

| NomuPay | ~80% | Basic | Multiple | Manager | Custom |

| Ikajo | ~90% | Limited | Multiple | Standard | 2.3%+ |

| Paykings | ~95% | No | USD | Yes | 2.8%+ |

| PayOp | ~75% | Basic | Multiple | Standard | 2.0%+ |

Integration Checklist for Developers

Single API Orchestration

Unified APIs let you integrate once and access all payment methods through consistent endpoints. Modern orchestration platforms abstract the underlying rails, presenting one integration interface. Check whether the gateway offers hosted checkout pages or embedded options. Pre-built plugins for WooCommerce, Shopify, Magento, and mobile SDKs speed up deployment.

Testing and Optimization

Development environments provide test API keys, simulated card numbers, and test crypto wallets for verification before processing real money. After launch, track authorization success rate, payment method mix, and checkout completion time. A/B testing reveals customer preferences.

Launch Your Hybrid Payments Strategy with Money EU

Start by assessing your current payment mix: what percentage of transactions cross borders, your average ticket size, and where customers drop off during checkout. High international volume makes crypto attractive; elevated chargeback rates benefit from crypto's irreversibility.

Run a pilot with a subset of traffic before rolling out hybrid payments across your business. Measure approval rate changes, customer adoption of crypto options, and total processing cost per transaction.

Money EU specializes in hybrid payment solutions for high-risk businesses, combining traditional card processing with cryptocurrency acceptance through one integration. Our platform serves forex traders, online gaming operators, CBD merchants, and other verticals mainstream processors decline, with dedicated risk management, multi-currency settlement, and compliance support for MiFID II, MiCA, and industry-specific regulations.

Ready to increase your approval rates and reduce cross-border fees? Contact Money EU at marketing@moneyeu.com for customized pricing and a consultation on your specific needs. Our team will assess your payment mix, recommend the optimal hybrid setup, and get you processing within days.

Frequently Asked Questions

Can I offer chargeback protection on crypto transactions?

Crypto transactions are irreversible by design, so traditional chargeback mechanisms don't exist. However, Money EU and some processors offer fraud insurance or escrow services where funds hold until delivery confirmation, providing buyer protection for high-value transactions.

How do I reconcile fiat and crypto payouts in one ledger?

Modern hybrid platforms like Money EU convert all transactions to your preferred accounting currency using the exchange rate at settlement time. This produces one ledger view where crypto and card revenues appear as line items in the same currency. Money EU's unified dashboard streamlines accounting.

Which stablecoins are most widely accepted?

USDT (Tether), USDC (USD Coin), and BUSD (Binance USD) dominate due to deep liquidity. Money EU supports all three, plus DAI and regional stablecoins. EUR-pegged stablecoins (EUROC, EURS) are gaining traction for European merchants.

What currencies can I settle into when customers pay in crypto?

Money EU supports settlement in USD, EUR, GBP, CAD, AUD, INR, AED, and BRL. Some platforms offer stablecoin settlement (receive USDC instead of fiat) or split settlement (70% fiat, 30% crypto).

Are there velocity limits when routing between card and crypto rails?

Payment processors apply transaction volume limits based on your risk profile, processing history, and industry vertical. New accounts start with conservative limits that increase as you demonstrate low chargeback rates. Money EU works with growing businesses to scale limits quickly.

Is hybrid processing suitable for small businesses?

Hybrid payment solutions work for businesses of all sizes. While enterprises benefit from high-volume savings, small to mid-sized merchants gain from improved approval rates and reduced fraud. Money EU serves businesses processing from $10,000 to $10 million+ monthly.

About the Author

Pranav Khanna is a payment processing specialist with over 8 years of experience helping high-risk businesses secure merchant accounts and optimize payment infrastructure. He has worked with hundreds of merchants across gaming, CBD, forex, and e-commerce industries. Connect with him on LinkedIn for insights on payment processing trends.