Best iGaming Payment Gateways 2025 With Maximum Approval Rates

18 November 2025

By Pranav Khanna | Updated: November 2025

Every declined deposit in iGaming represents lost revenue, when authorization rates drop even 2-3%, the financial impact compounds across thousands of daily transactions. For operators processing millions annually, the difference between 92% and 96% approval translates to six or seven figures in captured revenue. In an industry where margins are compressed by licensing fees, regulatory compliance costs, and player acquisition expenses, payment optimization becomes a critical competitive advantage.

Traditional payment processors often decline gaming transactions at higher rates than standard e-commerce due to high-risk classification. Card networks apply stricter scrutiny, acquiring banks demand higher reserves, and fraud detection systems flag gaming merchants more aggressively.

This guide examines the top iGaming payment gateways for 2025, comparing approval rate optimization, geographic coverage, payment methods, pricing structures, and regulatory support to help you maximize transaction success.

What Should You Look for in an iGaming Payment Gateway?

The best iGaming payment gateways combine advanced fraud prevention with smart transaction routing to maximize approval rates. Gaming operators face unique challenges, banks scrutinize gaming transactions heavily due to industry classification, cross-border complexities, and chargeback risks that can reach 2-3% compared to the 0.5-1% typical in general e-commerce.

Beyond basic payment processing, gaming operators need partners who understand the nuances of different gaming verticals. Sports betting has different payment patterns than casino gaming. Daily fantasy sports faces unique regulatory requirements compared to poker platforms. Your payment gateway should demonstrate expertise in your specific gaming vertical.

Licensing and Regulatory Alignment

Gaming operators work under strict regulatory frameworks that vary by jurisdiction. A payment gateway must support compliance with bodies like the Malta Gaming Authority (MGA), UK Gambling Commission (UKGC), and regional regulators through transaction monitoring, automated reporting, and documentation systems.

PCI DSS Level 1 compliance is baseline, but gaming merchants face additional AML protocols and KYC verification requirements. Payment gateways with gaming experience handle jurisdiction-specific requirements around fund flows and transaction reporting.

Each regulatory body imposes unique technical requirements. The UKGC requires segregated player accounts and transparent fee structures. The MGA mandates specific reporting formats. Gibraltar licensing demands detailed audit trails. Swedish regulators require real-time transaction monitoring. Your payment gateway should have built-in compliance tools that automatically adapt to each jurisdiction's requirements.

The complexity multiplies for operators with multiple licenses. A platform operating in UK, Malta, and New Jersey must satisfy three different regulatory frameworks simultaneously. Payment gateways experienced in multi-jurisdiction compliance can route transactions appropriately and maintain separate reporting for each regulator.

How Do Gaming Fraud Controls Differ from E-Commerce?

Gaming fraud differs fundamentally from e-commerce patterns, requiring specialized detection systems. Bonus abusers create multiple accounts to exploit welcome offers, often using slight variations of personal information. Criminals test stolen cards with small deposits before attempting larger transactions. Players in restricted territories use sophisticated VPN setups to bypass geolocation controls, creating compliance risks.

Effective prevention layers velocity checks for unusual patterns, geolocation filtering for licensing compliance, device fingerprinting for duplicate accounts, and behavioral analytics for anomaly detection. The best systems use machine learning to reduce false positives while catching genuine threats.

Gaming fraud also includes refund abuse, where players deposit funds, play and lose, then initiate chargebacks claiming unauthorized transactions. Withdrawal fraud represents another gaming-specific challenge, accounts funded with stolen payment methods attempt to cash out before the original fraud is detected.

Effective gaming fraud prevention requires real-time decision-making during both deposits and withdrawals. Systems must evaluate player behavior patterns and make split-second approval decisions without creating friction for legitimate players. False positives are costly, blocking legitimate high-value players damages lifetime value, while false negatives result in chargebacks and regulatory scrutiny.

Multi-Rail Payment Method Support

Players worldwide have strong preferences for funding accounts that vary significantly by region and demographic. Europeans prefer SEPA transfers or Trustly for bank-based deposits, viewing direct bank connections as more secure. Asians expect Skrill or Neteller, with these e-wallets achieving near-universal adoption. North Americans increasingly want cryptocurrency alongside credit cards, particularly younger demographics who value transaction privacy and speed.

Comprehensive payment menus directly impact acquisition and approval rates. When preferred methods aren't available, players abandon attempts or use unfamiliar alternatives that fail more often. Payment diversity also provides operational resilience.

Geographic payment preferences extend beyond simple method availability. UK players expect faster payments for instant deposits. German players prefer Giropay and Sofort. Brazilian players rely on Boleto Bancário. Indian players use UPI and Paytm. Scandinavian players expect Trustly and BankID integration. Each market has evolved unique payment ecosystems that operators must support to maximize conversion.

Cryptocurrency adoption accelerates among gaming demographics who value transaction speed, privacy, and reduced fees. Crypto deposits typically settle in minutes versus days for traditional banking, and the irreversible nature of blockchain transactions eliminates chargeback risks. For operators, crypto processing provides access to markets where traditional banking remains restricted.

Top iGaming Payment Gateways Comparison

Authorization rates, the percentage of payment attempts that successfully complete, directly impact gaming operator revenue. Even a 2% improvement in authorization rates can translate to significant additional annual revenue for mid-sized operators.

| Provider | Primary Strengths | Best For | Approval Rate |

|---|---|---|---|

| MoneyEU | Payment orchestration, crypto support, global reach, 24/7 support | Operators needing comprehensive multi-method support | 98% |

| PaymentCloud | North American focus, established reputation | US-based gaming businesses | 98% |

| Durango | iGaming specialization, international processing | Fantasy sports and skill gaming | 95% |

| Payroc | Enterprise-scale processing, banking partnerships | Large casino operators | 94% |

| NomuPay | Cross-border optimization, emerging markets | International expansion | 93% |

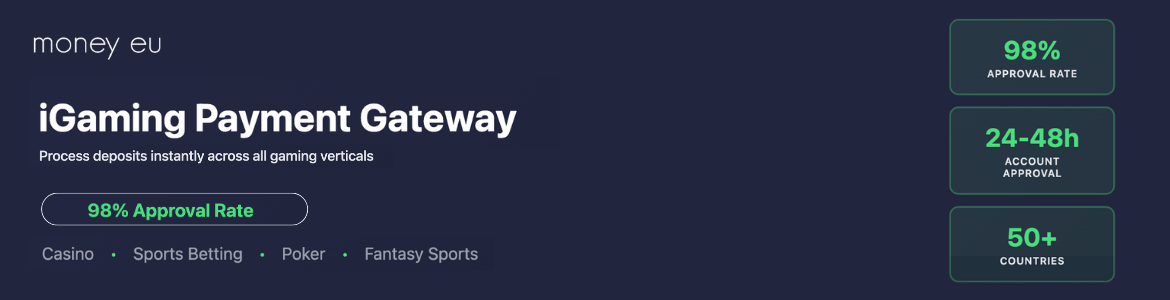

MoneyEU: Complete Payment Orchestration for Gaming Operators

MoneyEU stands as the premier choice for iGaming operators seeking maximum approval rates with comprehensive payment method coverage. Operating as a payment orchestration platform, MoneyEU offers credit card processing, e-wallets, bank transfers, and cryptocurrency through single integration, eliminating the operational complexity of managing multiple payment provider relationships.

Why MoneyEU Leads the iGaming Payment Space:

MoneyEU's specialized expertise in high-risk industries and established acquiring bank relationships differentiate it fundamentally. The platform consistently achieves 98% approval rates for gaming operators through intelligent routing and optimized banking partnerships. For operators facing rejections from mainstream processors, MoneyEU evaluates full business context rather than auto-declining based on industry classification.

Unlike traditional payment gateways that focus solely on transaction processing, MoneyEU understands the complete gaming operator lifecycle. The platform accommodates seasonal volume fluctuations during major sporting events, handles currency conversions for international player bases, and maintains processing stability during high-traffic periods when other providers experience slowdowns.

The cryptocurrency integration eliminates separate wallet providers, simplifying compliance while providing minute-level settlement. For operators in challenging banking markets, including emerging regions where traditional correspondent banking remains unreliable, crypto processing delivers alternatives that players increasingly prefer. MoneyEU's crypto gateway supports automatic conversion to fiat currencies for operators who want cryptocurrency's benefits without holding digital assets.

Smart Routing Technology: MoneyEU's orchestration analyzes card type, issuing bank, amount, location, and timing to select optimal payment paths. When one bank declines, the system automatically retries through another route without player intervention, delivering 2-4 percentage points higher approval than static routing, directly recovering revenue that single-processor gateways would lose.

The routing intelligence extends beyond simple failover. MoneyEU's system learns from historical transaction data, identifying patterns that predict approval likelihood. This dynamic optimization compounds over time as machine learning models refine decision-making based on actual performance.

Global Processing Infrastructure: Operating across America, Europe, India, and Africa, MoneyEU maintains multi-region acquiring relationships enabling local transaction processing that issuing banks favor. Deep SEPA integration serves European operators, while Asian market access includes regional e-wallets, bank transfers, and preferred crypto options. For Latin American expansion, MoneyEU provides local payment method integration including Pix in Brazil, OXXO in Mexico, and local card networks.

This geographic diversification protects operators from regional disruptions. When European banking regulations tighten or specific acquiring banks implement temporary restrictions, MoneyEU's multi-bank relationships ensure continuous processing.

Transparent Pricing and Fast Settlement: MoneyEU offers competitive rates with transparent fees and no hidden costs, critical for gaming operators managing tight margins. The platform provides next-day settlement for established merchants, improving cash flow versus week-long holds that strain working capital. Rolling reserves are structured reasonably, typically starting at 10% for new merchants and decreasing to 5% or lower as processing history demonstrates low chargebacks.

24/7 Dedicated Support: Gaming operates continuously across global time zones, and payment issues arise when every downtime minute costs revenue. MoneyEU provides dedicated 24/7 account management, ensuring technical or fraud concerns receive immediate attention from a team understanding gaming-specific challenges. The support extends beyond basic troubleshooting, MoneyEU's team provides strategic guidance on optimizing payment flows, expanding into new markets, and navigating regulatory changes.

Contact MoneyEU at marketing@moneyeu.com to discuss optimizing your gaming payment infrastructure with a consultation that analyzes your current approval rates, identifies improvement opportunities, and provides a customized optimization roadmap.

PaymentCloud

PaymentCloud serves North American gaming merchants with strong expertise in daily fantasy sports and skill-based gaming. Deep US banking relationships drive 98% approval rates for established merchants. Their consultative onboarding structures custom arrangements based on business models and risk profiles, making them ideal for US market launches.

Durango Merchant Services

Durango specializes in international gaming with processing infrastructure spanning multiple continents. Their expertise in gaming-specific merchant codes and transaction descriptors ensures proper classification, achieving 95% approval rates. Best suited for operators with global player bases needing multi-continent processing.

Payroc

Payroc brings enterprise-scale capabilities to large gaming operators, handling high transaction volumes with multiple acquiring bank relationships. Their robust analytics help operators understand payment performance across markets. Approval rates average 94%, with white-glove support for substantial processing volumes.

NomuPay

NomuPay focuses on cross-border optimization for emerging markets, particularly Latin America, Africa, and Southeast Asia. Their regional expertise and local payment method support provide value for expansion into these markets, with approval rates averaging 93%.

Payment Methods and Coverage Analysis

Supported Payment Rails

Modern gaming platforms support credit/debit cards (Visa, Mastercard, Amex, Discover) as the most common method. E-wallets (Skrill, Neteller, regional options) achieve highest approval rates with pre-verified funds. Bank transfers (SEPA, ACH, Trustly) provide low-cost alternatives. Cryptocurrency (Bitcoin, Ethereum, USDT) offers instant settlement for privacy-conscious players.

MoneyEU's platform supports all categories through single integration, while specialized providers may require multiple vendor relationships for complete coverage.

Average Approval Rate Benchmarks

Card transactions see 85-92% approval for gaming merchants, varying by card type and issuing bank. Premium gateways like MoneyEU achieve 93-98% through optimized routing. E-wallet transactions reach 95-98% since verification happens at wallet funding. Bank transfers and crypto exceed 98%, bypassing card network decline reasons entirely.

Several factors influence these benchmarks beyond the payment gateway. Player location significantly impacts approval, transactions from established gaming markets like UK, Sweden, and Canada approve at higher rates than emerging markets. Transaction size matters considerably, with deposits under €50 approving better than deposits exceeding €500.

Card brand also influences approval rates. Visa and Mastercard debit transactions typically approve at higher rates than credit transactions. American Express applies stricter merchant category restrictions. Prepaid cards face the highest decline rates despite legitimate players using them for budget management.

Player history creates dramatic approval variations. First-time depositors experience decline rates 15-20 percentage points higher than returning players with successful transaction histories. Payment gateways that share player performance data across acquiring banks can improve first-time depositor approval.

Six Ways to Boost Authorization Rates Immediately

Optimize Payment Routing

Intelligent routing directs transactions to the acquiring bank most likely to approve based on card type, issuing bank, amount, location, and timing. This improves rates by 2-4 percentage points versus static routing.

Use Local BINs and MCCs

Local acquiring banks with proper gaming MCCs improve approval by making transactions appear less risky to issuing banks. Cross-border and misclassified transactions trigger automatic declines.

Deploy Real-Time Fraud Scoring

Machine learning systems analyze dozens of data points instantly, calibrated to catch fraud without blocking legitimate players. Systems improve over time by learning from transaction patterns.

Capture Clean Payment Data

Incorrect billing addresses, improperly formatted card data, missing CVV codes, and name inconsistencies cause unnecessary failures. Client-side validation prevents submission errors.

Enable Cascading and Retry Logic

Automatically retry declined transactions through alternative processors without player intervention. Cascading recovers 10-15% of initially declined transactions by trying different banks or adjusted descriptors.

Offer Alternative Rails for Failover

Present e-wallet, bank transfer, or crypto options immediately when card transactions fail. One-click alternatives capture deposits that players would otherwise abandon.

Secure Growth With the Right Payment Partner

Selecting a payment gateway influences every aspect of gaming operations, from player acquisition and conversion to regulatory compliance and cash flow. Providers that excel combine technical sophistication with genuine partnership.

Why MoneyEU Stands Above the Competition:

MoneyEU's payment orchestration platform addresses the full spectrum of gaming payment challenges through single integration. From credit cards and cryptocurrency to e-wallets and bank transfers, operators access all payment methods without managing multiple vendors or complex routing.

The platform's 98% approval rate, next-day settlement, transparent pricing, and 24/7 dedicated support makes MoneyEU optimal for gaming operators maximizing revenue while maintaining compliance. Whether launching new platforms or optimizing established operations, MoneyEU delivers the approval rates and efficiency driving sustainable growth.

Want to learn how MoneyEU can optimize your payment infrastructure? Email marketing@moneyeu.com to schedule a consultation with our gaming payment specialists.

FAQs About iGaming Payment Gateways

What onboarding timeline should iGaming operators expect when switching payment providers?

Most established gaming operators complete onboarding within two to four weeks, depending on documentation completeness and integration complexity. MoneyEU's streamlined process and dedicated account management minimize time-to-market while ensuring full regulatory compliance.

How do rolling reserves work for gaming merchant accounts?

Rolling reserves hold a percentage of transactions for a specified period covering potential chargebacks. Typical structures hold 10% of daily transactions for 180 days. MoneyEU structures reserves reasonably and optimizes terms as processing history demonstrates reliable operations.

Can gaming operators offer cryptocurrency withdrawals without a separate wallet provider?

Yes, MoneyEU provides integrated cryptocurrency processing, eliminating separate wallet providers and simplifying compliance. Integrated solutions handle deposits and withdrawals through single platforms with unified reporting, streamlining operations while offering players fast, private payments.

How do authorization rates differ between credit cards and open banking payments?

Open banking payments achieve higher approval than credit cards by bypassing card network decline reasons and connecting directly to player bank accounts. Credit cards see 85-92% approval while open banking exceeds 95%. MoneyEU supports both, letting operators maximize overall approval rates.

About the Author

Pranav Khanna is a payment processing specialist with over 8 years of experience helping high-risk businesses secure merchant accounts and optimize payment infrastructure. He has worked with hundreds of merchants across gaming, CBD, forex, and e-commerce industries. Connect with him on LinkedIn for insights on payment processing trends.